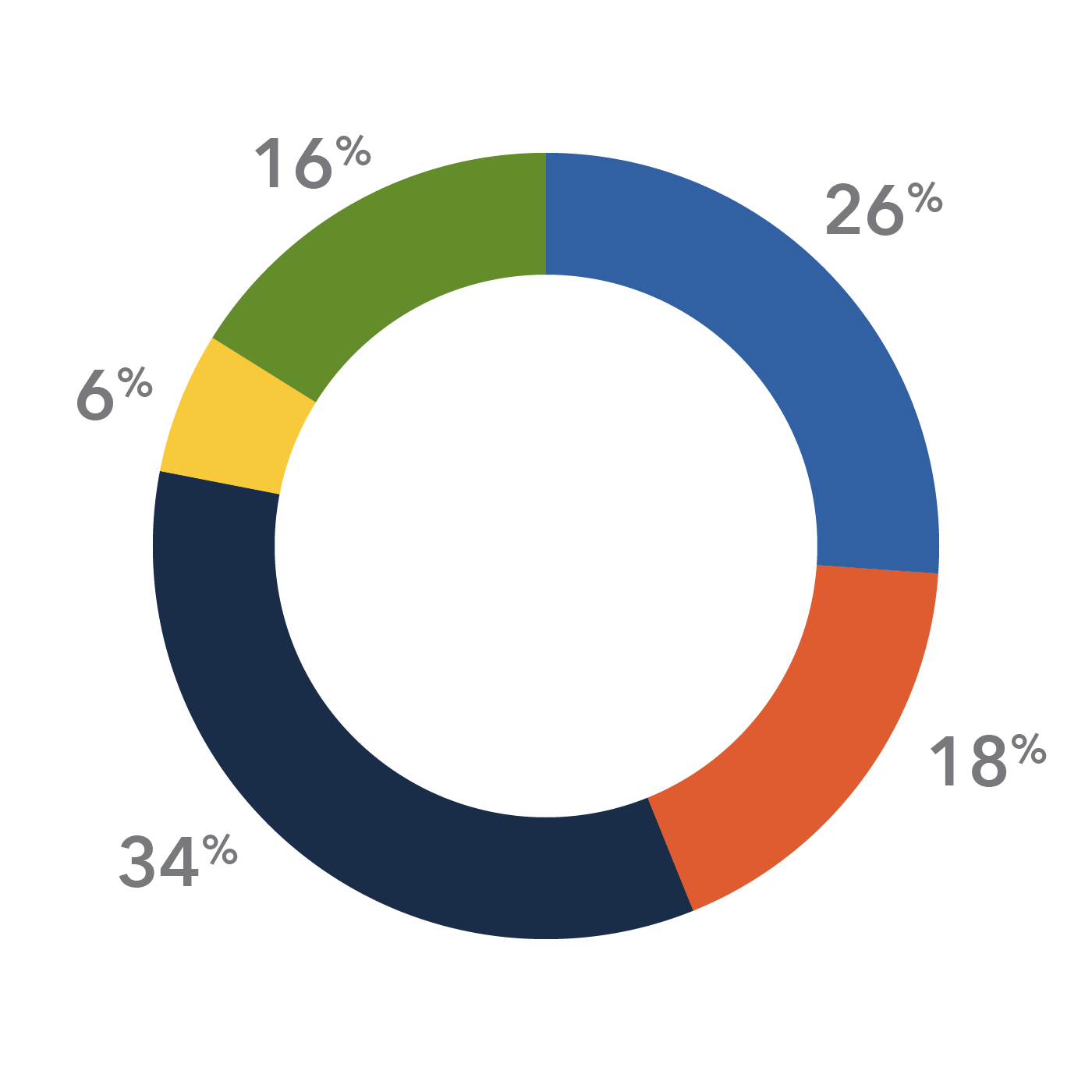

Age-Based 1

(Ages 0-8)

U.S. Large-Cap Equity

International Equity

Global Equity

Fixed Income

| U.S. Large-Cap Equity | |

| TIAA-CREF S&P 500 Index | 18.0% |

| Virtus NFJ Dividend Value | 2.0% |

| Virtus Silvant Focused Growth | 6.0% |

| International Equity | |

| Dodge and Cox International Stock | 5.0% |

| TIAA-CREF International Equity Index | 8.0% |

| Virtus Emerging Markets Opportunities | 5.0% |

| Global Equity | |

| American Funds New Perspective | 11.0% |

| Virtus Duff & Phelps Global Real Estate Securities | 6.0% |

| Virtus Global Allocation (60%)+ | 17.0% |

| Commodity-Related | |

| DFA Commodity Strategy Portfolio | 6.0% |

| Fixed Income | |

| DFA Inflation Protected Securities Portfolio | 1.0% |

| Metropolitan West Total Return Bond | 1.0% |

| PIMCO Real Return | 2.0% |

| Virtus Global Allocation (40%)+ | 11.0% |

| Virtus Newfleet Multi-Sector Intermediate Bond | 1.0% |

+The Virtus Global Allocation Fund is allocated 60% to global equities, 40% to fixed income in line with its blended benchmark which is 60% MSCI All Country World Index and 40% Bloomberg US Aggregate Index, for the Age-based investment portfolios.

Underlying Funds (in alphabetical order)

American Funds New Perspective Fund (FNPFX)

Investment Objective and Principal Strategies

The fund's investment objective is long-term growth of capital. The Fund seeks to take advantage of investment opportunities generated by changes in international trade patterns and economic and political relationships by investing in common stocks of companies located around the world. In pursuing its investment objective, the fund invests primarily in common stocks that the investment adviser believes have the potential for growth.

The investment adviser uses a system of multiple portfolio managers in managing the fund’s assets. Under this approach, the portfolio of the fund is divided into segments managed by individual managers.

The fund relies on the professional judgment of its investment adviser to make decisions about the fund’s portfolio investments. The basic investment philosophy of the investment adviser is to seek to invest in attractively valued companies that, in its opinion, represent good, long-term investment opportunities. Securities may be sold when the investment adviser believes that they no longer represent relatively attractive investment opportunities.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are market conditions, issuer risks, investing in growth-oriented stocks, investing outside the United States and management risk.

DFA Commodity Strategy Portfolio (DCMSX)

Investment Objective and Principal Strategies

The Portfolio's investment objective is to seek total return consisting of capital appreciation and current income. The Portfolio seeks to achieve its investment objective by generally investing in a universe of allowable commodity-linked derivative instruments and fixed income investment opportunities. The Portfolio gains exposure to commodities markets by investing in derivative instruments, such as structured notes whose principal and/or coupon payments are linked to commodities or commodity indices, in swap agreements, and/or in other commodity-linked instruments (such as futures contracts on individual commodities or commodity indices). The Portfolio may invest up to 25% of its total assets in Dimensional Cayman Commodity Fund I Ltd. (the “Subsidiary”), a wholly-owned subsidiary of the Portfolio formed in the Cayman Islands, which has the same investment objective as the Portfolio and has a strategy of investing in derivative instruments, such as commodity-linked swap agreements and other commodity-linked instruments, futures contracts on individual commodities or commodity indices, and options on these instruments. The Portfolio, directly and/or through its investment in the Subsidiary, expects to use such derivatives extensively as part of its investment strategy.

The Portfolio will invest in obligations issued or guaranteed by the U.S. and foreign governments, their agencies and instrumentalities, bank obligations, commercial paper, repurchase agreements, obligations of other domestic and foreign issuers having investment grade ratings (e.g., rated AAA to BBB- by S&P Global Ratings (“S&P”) or Fitch Ratings Ltd. (“Fitch”) or Aaa to Baa3 by Moody’s Investors Service, Inc. (“Moody’s”)), securities of domestic or foreign issuers denominated in U.S. dollars but not trading in the United States, and obligations of supranational organizations. At the present time, Dimensional Fund Advisors LP (the “Advisor”) expects that most fixed income investments will be made in the obligations of issuers that are located in developed countries. However, in the future, the Advisor anticipates investing in issuers located in other countries as well. The fixed income securities in which the Portfolio invests are considered investment grade at the time of purchase. In addition, the Portfolio is authorized to invest more than 25% of its total assets in U.S. Treasury bonds, bills and notes, and obligations of federal agencies and instrumentalities.

The Portfolio’s fixed income securities primarily will mature within five years from the date of settlement, and the Portfolio maintains an average portfolio duration of three years or less. Duration is a measure of the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. Similarly, a portfolio with a longer average portfolio duration will be more sensitive to changes in interest rates than a fund with a shorter average portfolio duration. In making purchase decisions, if the expected term premium is greater for longer-term securities in the eligible maturity range, the Advisor will focus investment in the longer-term area, otherwise, the Portfolio will focus investment in the shorter-term area of the eligible maturity range.

The Portfolio’s investments may include foreign securities denominated in foreign currencies. The Portfolio intends to hedge foreign currency exposure to protect against uncertainty in the level of future foreign currency rates, to hedge against fluctuations in currency exchange rates or to transfer balances from one currency to another. The Portfolio may hedge such currency exposure by entering into foreign currency forward contracts. In regard to currency hedging, it is generally not possible to precisely match the foreign currency exposure of such foreign currency forward contracts to the value of the securities involved due to fluctuations in the market values of such securities and cash flows into and out of the Portfolio between the date a foreign currency forward contract is entered into and the date it expires. The Portfolio also may enter into credit default swaps on issuers or indices to buy or sell credit protection to hedge its credit exposure, gain market or issuer exposure without owning the underlying securities, or increase the Portfolio’s expected total return. The Portfolio may also use futures contracts and options on futures contracts to adjust market exposure based on actual or expected cash inflows to or outflows from the Portfolio.

The Portfolio may lend its portfolio securities to generate additional income.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are market risk, commodity risk, derivatives risk, focus risk, foreign securities and currencies risk, foreign government debt risk, interest rate risk, credit risk, call risk, liquidity risk, subsidiary risk, tax risk, leveraging risk, regulatory risk, valuation risk, securities lending risk, operational risk and cyber security risk.

DFA Inflation-Protected Securities Portfolio (DIPSX)

Investment Objective and Principal Strategies

The fund's investment objective is to provide inflation protection and earn current income consistent with inflation-protected securities. The Portfolio seeks its investment objective by investing in a universe of inflation-protected securities that are structured to provide returns linked to the rate of inflation over the long-term. The Inflation-Protected Portfolio ordinarily invests in inflation-protected securities issued by the U.S. Government and its agencies and instrumentalities and the credit quality of such inflation-protected securities will be that of such applicable U.S. government, agency or instrumentality issuer.

As a non-fundamental policy, under normal circumstances, the Portfolio will invest at least 80% of its net assets in inflation-protected securities. Inflation-protected securities (also known as inflation-indexed securities) are securities whose principal and/or interest payments are adjusted for inflation, unlike conventional debt securities that make fixed principal and interest payments. Inflation-protected securities include Treasury Inflation-Protected Securities (“TIPS”), which are securities issued by the U.S. Treasury. The principal value of TIPS is adjusted for inflation (payable at maturity) and the semi-annual interest payments by TIPS equal a fixed percentage of the inflation-adjusted principal amount. These inflation adjustments are based upon the Consumer Price Index for Urban Consumers (CPI-U). The original principal value of TIPS is guaranteed. At maturity, TIPS are redeemed at the greater of their inflation-adjusted principal or paramount at original issue. Other types of inflation-protected securities may use other methods to adjust for inflation and other measures of inflation. In addition, inflation-protected securities issued by entities other than the U.S. Treasury may not provide a guarantee of principal value at maturity.

Generally, the Inflation-Protected Portfolio will purchase inflation-protected securities with maturities between five and twenty years from the date of settlement, although it is anticipated that, at times, the Portfolio will purchase securities outside of this range. Under normal circumstances, when determining its duration, the Portfolio will consider an average duration similar to its benchmark, the Bloomberg Barclays U.S. TIPS Index, which was approximately 7.49 years as of December 31, 2019. Duration is a measure of the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates.

The Inflation-Protected Portfolio is authorized to invest more than 25% of its total assets in U.S. Treasury bonds, bills and notes and obligations of U.S. government agencies and instrumentalities. The Portfolio will not shift the maturity of its investments in anticipation of interest rate movements.

The Inflation-Protected Portfolio may purchase or sell futures contracts and options on futures contracts, to adjust market exposure based on actual or expected cash inflows to or outflows from the Portfolio. The Portfolio does not intend to sell futures contracts to establish short positions in individual securities or to use derivatives for purposes of speculation or leveraging investment returns.

The Inflation-Protected Portfolio may lend its portfolio securities to generate additional income.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are market risk, interest rate risk, inflation-protected securities tax risk, inflation-protected securities interest rate risk, credit risk, risks of investing for inflation protection, income risk, liquidity risk, derivatives risk, securities lending risk, operational risk and cyber security risk.

Dodge and Cox International Stock Fund (DODFX)

Investment Objective and Principal Strategies

The fund's investment objective is long-term growth of principal and income. The Fund seeks to achieve its investment objective by investing primarily in a diversified portfolio of equity securities issued by non-U.S. companies from at least three different countries, which may include emerging market countries. The Fund is not required to allocate its investments in set percentages in particular countries and may invest in emerging markets without limit. Under normal circumstances, the Fund will invest at least 80% of its total assets in equity securities of non-U.S. companies, including common stocks, depositary receipts evidencing ownership of common stocks, preferred stocks, securities convertible into common stocks, and securities that carry the right to buy common stocks (e.g., rights and warrants). The Fund may enter into currency forward contracts, currency swaps, or currency futures contracts to hedge direct and/or indirect foreign currency exposure. The Fund may use futures or options referencing stock indices to hedge against a general downturn in the equity markets. The Fund also may also use equity index futures to equitize, or create equity market exposure, approximately equal to some or all of its non-equity assets.

The Fund typically invests in medium-to-large well-established companies based on standards of the applicable market. In selecting investments, the Fund typically invests in companies that, in Dodge & Cox’s opinion, appear to be temporarily undervalued by the stock market but have a favorable outlook for long-term growth. The Fund also focuses on the underlying financial condition and prospects of individual companies, including future earnings, cash flow, and dividends. Various other factors, including financial strength, economic condition, competitive advantage, quality of the business franchise, and the reputation, experience, and competence of a company’s management are weighed against valuation in selecting individual securities. The Fund also considers the economic and political stability of the country where the issuer is located and the protections provided to shareholders.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are equity risk, market risk, manager risk, non-U.S. investment risk, emerging markets risk, non-U.S. currency risk, liquidity risk, and derivatives risk.

Metropolitan West Total Return Bond Fund (MWTSX)

Investment Objective and Principal Strategies

The fund's investment objective is to maximize long-term total return. The Fund pursues its objective by investing, under normal circumstances, at least 80% of its net assets in investment grade fixed income securities or unrated securities determined by the Adviser to be of comparable quality. Up to 20% of the Fund’s net assets may be invested in securities rated below investment grade (commonly known as “junk bonds”) or unrated securities determined by the Adviser to be of comparable quality. The Fund also invests, under normal circumstances, at least 80% of its net assets, plus any borrowings for investment purposes, in fixed income securities it regards as bonds. A bond is a security or instrument having one or more of the following characteristics: a fixed-income security, a security issued at a discount to its face value, a security that pays interest or a security with a stated principal amount that requires repayment of some or all of the principal amount to the holder of the security. The term “bond” is interpreted broadly by the Adviser as an instrument or security evidencing a promise to pay some amount rather than evidencing the corporate ownership of equity, unless that equity represents an indirect or derivative interest in one or more bonds. Under normal circumstances, the Fund’s portfolio duration is two to eight years and the Fund’s dollar-weighted average maturity ranges from two to fifteen years.

Duration is a measure of the expected life of a fixed income security that is used to determine the sensitivity of a security to changes in interest rates.

The Fund invests in the U.S. and abroad, including emerging markets, and may purchase securities of varying maturities issued by domestic and foreign corporations and governments. The Fund may invest up to 25% of its assets in foreign securities that are denominated in U.S. dollars. The Fund may invest up to 15% of its assets in securities of foreign issuers that are not denominated in U.S. dollars. The Fund may invest up to 10% of its assets in emerging markets securities. The Adviser focuses the Fund’s portfolio holdings in areas of the bond market that the Adviser believes to be relatively under-valued, based on its analysis of quality, sector, coupon or maturity, and that the Adviser believes offer attractive prospective risk-adjusted returns compared to other segments of the bond market.

The Fund’s investments include various types of bonds and debt securities, including corporate bonds, notes, mortgage-related and asset-backed securities (including collateralized debt obligations, which in turn include collateralized bond obligations and collateralized loan obligations), bank loans, U.S. and non-U.S. money market securities, municipal securities, derivatives including credit default swaps and other swaps, futures, options and currency forward contracts, defaulted debt securities, private placements and restricted securities. The Fund’s fixed income investments may have interest rates that are fixed, variable or floating.

Derivatives are used in an effort to hedge investments, for risk management, or to increase income or gains for the Fund. The Fund may also seek to obtain market exposure to the securities in which it invests by entering into a series of purchase and sale contracts or by using other investment techniques.

The Fund may normally short sell up to 25% of the value of its total assets.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are debt securities risk, market risk, interest rate risk, credit risk, price volatility risk, issuer risk, liquidity risk, frequent trading risk, valuation risk, prepayment risk, extension risk, mortgage-backed securities risk, asset-backed securities risk, U.S. treasury obligations risk, U.S. government securities risk, leveraging risk, counterparty risk, derivatives risk, swap agreements risk, futures contracts risk, junk bond risk, unrated securities risk, short sale risk, foreign investing risk, foreign currency risk, emerging markets risk, distressed and defaulted securities risk, securities selection risk, portfolio management risk and public health emergency risks.

PIMCO Real Return Fund (PRRIX)

Investment Objective and Principal Strategies

The fund's investment objective is maximum real return, consistent with preservation of capital and prudent investment management. The Fund seeks its investment objective by investing under normal circumstances at least 80% of its net assets in inflation-indexed bonds of varying maturities issued by the U.S. and non-U.S. governments, their agencies or instrumentalities, and corporations, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. Assets not invested in inflation-indexed bonds may be invested in other types of Fixed Income Instruments. “Fixed Income Instruments” include bonds, debt securities and other similar instruments issued by various U.S. and non-U.S. public- or private-sector entities. Inflation-indexed bonds are fixed income securities that are structured to provide protection against inflation. The value of the bond’s principal or the interest income paid on the bond is adjusted to track changes in an official inflation measure. The U.S. Treasury uses the Consumer Price Index for Urban Consumers as the inflation measure. Inflation-indexed bonds issued by a foreign government are generally adjusted to reflect a comparable inflation index, calculated by that government. “Real return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure. Additionally, “real yield” equals “nominal yield” less the market implied rate of inflation, and “nominal yield” is the interest rate that an issuer has promised to pay on an instrument that is not an inflation-linked instrument.

Duration is a measure used to determine the sensitivity of a security’s price to changes in interest rates. The longer a security’s duration, the more sensitive it will be to changes in interest rates. Effective duration, the most common method of calculating duration, takes into account that for certain bonds expected cash flows will fluctuate as interest rates change and is defined in nominal yield terms, which is market convention for most bond investors and managers. Because market convention for bonds is to use nominal yields to measure effective duration, effective duration for real return bonds, which are based on real yields, are converted through a conversion factor. The resulting nominal effective duration typically can range from 20% and 90% of the respective real effective duration. All security holdings will be measured in nominal effective duration terms. Similarly, the effective duration of the Bloomberg Barclays U.S. TIPS Index will be calculated using the same conversion factors. The effective duration of this Fund normally varies within three years (plus or minus) of the effective duration of the securities comprising the Bloomberg Barclays U.S. TIPS Index, as calculated by PIMCO, which as of May 31, 2020 was 7.84 years.

The Fund invests primarily in investment grade securities, but may invest up to 10% of its total assets in high yield securities (“junk bonds”) rated B or higher by Moody’s Investors Service, Inc. (“Moody’s”), or equivalently rated by Standard & Poor’s Ratings Services (“S&P”) or Fitch, Inc. (“Fitch”), or, if unrated, determined by PIMCO to be of comparable quality (except that within such 10% limitation, the Fund may invest in mortgage-related securities rated below B). In the event that ratings services assign different ratings to the same security, PIMCO will use the highest rating as the credit rating for that security.

The Fund also may invest up to 30% of its total assets in securities denominated in foreign currencies, and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. The Fund may invest up to 10% of its total assets in securities and instruments that are economically tied to emerging market countries (this limitation does not apply to investment grade sovereign debt denominated in the local currency with less than 1 year remaining to maturity, which means the Fund may invest, together with any other investments denominated in foreign currencies, up to 30% of its total assets in such instruments).The Fund will normally limit its foreign currency exposure (from non-U.S. dollar-denominated securities or currencies) to 20% of its total assets.

The Fund may invest, without limitation, in derivative instruments, such as options, futures contracts or swap agreements, or in mortgage- or asset backed securities, subject to applicable law and any other restrictions described in the Fund’s prospectus or Statement of Additional Information (the “SAI”). The Fund may purchase or sell securities on a when-issued, delayed delivery or forward commitment basis and may engage in short sales. The Fund may, without limitation, seek to obtain market exposure to the securities in which it primarily invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as buy backs or dollar rolls). The Fund may also invest up to 10% of its total assets in preferred securities.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are interest rate risk, call risk, credit risk, high yield risk, market risk, issuer risk, liquidity risk, derivatives risk, equity risk, mortgage-related and other asset-backed securities risk, foreign (non-U.S.) investment risk, emerging markets risk, sovereign debt risk, currency risk, leveraging risk, management risk, inflation-indexed security risk and short exposure risk.

TIAA-CREF International Equity Index (TCIEX)

Investment Objective and Principal Strategies

The fund's investment objective is to seek a favorable long-term total return, mainly through capital appreciation, by investing primarily in a portfolio of foreign equity investments based on a market index. Under normal circumstances, the Fund invests at least 80% of its assets in securities of its benchmark index, the Morgan Stanley Capital International EAFE® (Europe, Australasia, Far East) Index (the “MSCI EAFE Index”). The MSCI EAFE Index measures stock performance in certain countries outside North America. The Fund buys most, but not necessarily all, of the stocks included in its benchmark index, and will attempt to closely match the overall investment characteristics of its benchmark index. For purposes of the 80% investment policy, the term “assets” means net assets, plus the amount of any borrowings for investment purposes.

The Fund is designed to track various foreign equity markets as a whole or a segment of these markets. The Fund primarily invests its assets in equity securities its investment adviser, Teachers Advisors, LLC (“Advisors”), has selected to track a designated stock market index.

Because the return of an index is not reduced by investment and other operating expenses, the Fund’s ability to match the returns of the MSCI EAFE Index is negatively affected by the costs of buying and selling securities as well as the Fund’s fees and other expenses. The use of a particular index by the Fund is not a fundamental policy and may be changed without shareholder approval. The portfolio management team of Advisors will attempt to build a portfolio that generally matches the market weighted investment characteristics of the Fund’s benchmark index.

The Fund is classified as a diversified investment company, as defined under the Investment Company Act of 1940, as amended (the “1940 Act”). However, the Fund may become non-diversified under the 1940 Act without the approval of Fund shareholders solely as a result of a change in relative market capitalization or index weighting of one or more constituents of its benchmark index, the MSCI EAFE Index, which the Fund seeks to track.

Principle Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are market risk, issuer risk, foreign investment risk, index risk, large-cap risk, mid-cap risk, illiquid investments risk, currency risk and non-diversification risk.

TIAA-CREF S&P 500 Index (TIPSX)

Investment Objective and Principal Strategies

The fund's investment objective is to seek a favorable long-term total return, mainly through capital appreciation, by investing primarily in a portfolio of equity securities of large domestic companies selected to track U.S. equity markets based on a market index. Under normal circumstances, the Fund invests at least 80% of its assets in securities of its benchmark index, the S&P 500® Index. The S&P 500 Index includes 500 leading companies and captures approximately 80% coverage of available market capitalization of the U.S. equity market. The Fund buys most, but not necessarily all, of the stocks in its benchmark index, and will attempt to closely match the overall investment characteristics of its benchmark index. For purposes of the 80% investment policy, the term “assets” means net assets, plus the amount of any borrowings for investment purposes.

The Fund is designed to track various U.S. equity markets as a whole or a segment of these markets. The Fund primarily invests its assets in equity securities its investment adviser, Teachers Advisors, LLC (“Advisors”), has selected to track a designated stock market index. Because the return of an index is not reduced by investment and other operating expenses, the Fund’s ability to match the returns of the S&P 500 Index is negatively affected by the costs of buying and selling securities as well as the Fund’s fees and other expenses. The use of a particular index by the Fund is not a fundamental policy and may be changed without shareholder approval. The portfolio management team of Advisors will attempt to build a portfolio that generally matches the market weighted investment characteristics of the Fund’s benchmark index.

The Fund is classified as a diversified investment company, as defined under the Investment Company Act of 1940, as amended (the “1940 Act”). However, the Fund may become non-diversified under the 1940 Act without the approval of Fund shareholders solely as a result of a change in relative market capitalization or index weighting of one or more constituents of its benchmark index, the S&P 500 Index, which the Fund seeks to track.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are market risk, index risk, issuer risk, large-cap risk and non-diversification risk.

Virtus Duff & Phelps Global Real Estate Securities Fund (VRGEX)

Investment Objective and Principal Strategies

The Fund seeks long-term capital appreciation, with a secondary investment objective of income. The fund provides global exposure to the real estate securities market, focusing on owners and operators with recurring rental income. Under normal circumstances, the fund invests at least 80% of its assets in equity securities issued by U.S. and non-U.S companies of any capitalization that are principally engaged in the real estate industry, including common stock, preferred stock and other equity securities issued by real estate companies, such as real estate investment trusts (“REITs”) and similar REIT-like entities. The fund, under normal market conditions, will hold at least 40% of its assets in non-U.S. issuers, unless market conditions outside of the U.S. are deemed less favorable by the portfolio manager, in which case the fund would invest at least 30% of its assets in securities of non-U.S. issuers. Additionally, the fund normally invests in real estate-related securities of issuers in developed countries; however it may invest up to 20% of its assets in issuers incorporated in emerging market countries. The fund concentrates its assets in the real estate industry.

Principal Risks

The fund may not achieve its objective(s), and it is not intended to be a complete investment program. The value of the fund’s investments that supports your share value may decrease. If between the time you purchase shares and the time you sell shares the value of the fund’s investments decreases, you will lose money. Investment values can decrease for a number of reasons. Conditions affecting the overall economy, specific industries or companies in which the fund invests can be worse than expected, and investments may fail to perform as the subadviser expects. As a result, the value of your shares may decrease. Purchase and redemption activities by fund shareholders may impact the management of the fund and its ability to achieve its investment objective(s). The principal risks of investing in the fund are equity securities risk, real estate investment risk, industry/sector concentration risk, foreign investing risk, emerging market risk, equity real estate investment trust (REIT) securities risk, geographic concentration risk, market volatility risk, and redemption risk.

Virtus Emerging Markets Opportunities Fund (AEMOX)

Investment Objective and Principal Strategies

The Fund seeks maximum long-term capital appreciation. The fund seeks to achieve its investment objective by normally investing at least 80% of its net assets (plus borrowings made for investment purposes) in securities of companies that are tied economically to countries with emerging securities markets—that is, countries with securities markets that are, in the opinion of the portfolio managers, less sophisticated than more developed markets in terms of participation by investors, analyst coverage, liquidity and/or regulation. The fund will normally invest primarily in companies located in the countries represented in the fund’s benchmark, the MSCI Emerging Markets Index (“Emerging Market Countries”), and have exposure to at least 5 Emerging Market Countries. The fund may invest a substantial portion of its assets in equity securities of companies located in China. The portfolio managers seek to invest in emerging markets equities which they believe are benefiting from change not yet fully reflected in the market. Members of the portfolio management team believe that behavioral biases of investors contribute to market inefficiencies. Their quantitative investment process begins with a proprietary investment-return forecasting model which combines behavioral factors (which seek to capitalize on human behavioral biases (i.e., systematic tendencies) from financial analysts, company management and investors), with intrinsic and valuation factors (which are expected to provide tangible measures of a company’s true worth). The portfolio managers integrate this multi-factor approach with a proprietary risk model to form the basis of portfolio construction, with constraints at the individual security, country and industry levels to manage exposures relative to the benchmark. Additionally, all investment recommendations are thoroughly vetted on an individual company level to confirm the investment rationale and suitability before a purchase or sale. The fund normally invests primarily in common stocks, either directly or indirectly through depositary receipts. In addition to common stocks, equity securities in which the fund may invest include, without limitation, preferred stocks, convertible securities and warrants. The fund may invest in issuers of any size market capitalization, including smaller capitalization companies. The fund may utilize foreign currency exchange contracts, options, stock index futures contracts and other derivative instruments. The fund may also use participatory notes (“P-Notes”) or other equity-linked notes to gain exposure to issuers in certain countries. Although the fund did not invest significantly in derivative instruments as of the most recent fiscal year end, it may do so at any time.

Principal Risks

The fund may not achieve its objective(s), and it is not intended to be a complete investment program. The value of the fund’s investments that supports your share value may decrease. If between the time you purchase shares and the time you sell shares the value of the fund’s investments decreases, you will lose money. Investment values can decrease for a number of reasons. Conditions affecting the overall economy, specific industries or companies in which the fund invests can be worse than expected, and investments may fail to perform as the subadviser expects. As a result, the value of your shares may decrease. Purchase and redemption activities by fund shareholders may impact the management of the fund and its ability to achieve its investment objective(s). The principal risks of investing in the fund are identified below. The principal risks of investing in the fund are market volatility risk, issuer risk, equity securities risk, foreign investing risk, emerging markets risk, China-related risk, focused investment risk, small and medium market capitalization companies risk, allocation risk, counterparty risk, credit risk, currency rate risk, derivatives risk, leverage risk, liquidity risk, portfolio turnover risk, and preferred stocks risk.

Virtus Global Allocation Fund (AGASX)

Investment Objective and Principal Strategies

The fund's investment objective is to seek after-inflation capital appreciation and current income. The Fund seeks to achieve its investment objective through a combination of active allocation between asset classes and actively managed strategies within those asset classes. The Fund allocates its investments among asset classes in response to changing market, economic, and political factors and events that the portfolio managers believe may affect the value of the Fund’s investments. In making investment decisions for the Fund, the portfolio managers seek to identify trends and turning points in the global markets. To gain exposure to the various asset classes, the Fund incorporates actively managed underlying strategies, both directly through dedicated teams managing separate sleeves of the Fund and indirectly through investments in affiliated mutual funds, and may also make use of passive instruments. Under normal circumstances, the Fund invests directly and indirectly in globally diverse equity securities, fixed-income securities, and long and short positions across multiple asset classes. The Fund may also invest in exchange-traded funds (“ETFs”), unaffiliated mutual funds, other pooled vehicles and derivative instruments such as futures, among others. The Fund’s actively managed underlying strategies incorporate environmental, social and governance (“ESG”) factors into the selection of individual securities, and the portfolio managers also consider ESG factors in the construction of the overall portfolio. The Fund’s allocations to different strategies and instruments are expected to vary over time and from time to time.

The Fund’s baseline long-term allocation consists of 60% to global equity exposure (the “Equity Component”) and 40% to fixed income exposure (the “Fixed Income Component”), which is also the allocation of the blended benchmark index against which the Fund’s portfolio is managed. The Equity Component can include direct or indirect exposure to equity securities of any market capitalization, any sector and from any country, including emerging markets. The Fund expects to invest a significant portion of the Equity Component into Virtus NFJ Global Sustainability Fund, an affiliated mutual fund. The Fixed Income Component primarily consists of U.S. government and government agency debt, U.S. investment grade securities, U.S. securitized debt and U.S. short-term high yield corporate bonds. The portfolio managers will typically over- or under-weight the Fund’s portfolio against this baseline long-term allocation, depending upon the portfolio managers’ view of the relative attractiveness of the investment opportunities available, which will change over time. The Fund may also use an “Opportunistic Component” whereby it invests up to 30% of its assets in any combination of asset classes outside of the core holdings in the Equity Component or the Fixed Income Component. The particular asset classes represented by investments within the Opportunistic Component are expected to change over time as the portfolio managers identify trends and opportunities. Currently, the portfolio managers focus their Opportunistic Component positions around the following asset classes: emerging market debt, international debt (which may be denominated either in non-U.S. currencies or in U.S. dollars), intermediate and long-term high yield debt (commonly known as “junk bonds”), commodities, volatility-linked derivatives, and ETFs associated with ESG-oriented themes such as clean energy. Investments made through dedicated single asset class sleeves of the Fund such as fixed income and equity sleeves of the Fund (as described below) are not considered part of the Opportunistic Component, even where the specific type of instrument falls under one of the asset classes listed above as the current focus of the Opportunistic Component. The fact that investments are considered part of the Opportunistic Component does not mean that the Fund will hold them for only a short time; the portfolio managers have discretion to hold individual Opportunistic Component positions for medium or longer terms.

The portfolio managers adjust the Fund’s exposure to the Equity Component, the Fixed Income Component, and the Opportunistic Component in response to momentum and momentum reversion signals to increase the return potential in favorable markets. Momentum is the tendency of investments to exhibit persistence in their performance. Momentum reversion is the tendency that a performance trend will ultimately change and move in an opposite direction. The portfolio managers believe negative momentum suggests future periods of negative investment returns and increased volatility, whereas positive momentum suggests future periods of positive investment returns and typical levels of market volatility. When the portfolio managers recognize negative momentum for an asset class, the Fund may reduce its exposure to that asset class; and when they recognize positive momentum, the portfolio managers may increase exposure.

In addition to the momentum and momentum reversion signals, the portfolio managers also apply fundamental analysis to locate opportunities to seek to improve the Fund’s return. Fundamental analysis may contribute to an adjustment of the Fund’s exposure to the asset classes that exhibit the strongest return prospects. The fundamental analysis attempts to locate opportunities not identified from momentum-related signals. Furthermore, the portfolio managers expect to make use of volatility-linked derivatives to take advantage of differences between realized and implied volatility on a range of asset classes and to hedge risks in the portfolio.

In conjunction with their fundamental analysis, the portfolio managers seek to gain exposure to desired asset classes primarily through actively managed underlying strategies (including the strategy employed by Virtus NFJ Global Sustainability Fund within the Equity Component) that apply ESG factors and they consider ESG factors in the construction of the overall portfolio. The portfolio managers believe that investing in companies with strong records for managing ESG risks can generate long-term competitive financial returns and positive societal impact.

Within the Fixed Income Component limits described above, the Fund intends to make use of an integrated ESG security selection strategy (“U.S. Fixed Income Sleeve”) that is managed by a dedicated team of portfolio managers. This strategy focuses on investments in bonds, notes, other debt instruments and preferred securities, including derivatives relating to such investments. The portfolio managers invest in a diversified portfolio of high-quality bonds that generates return primarily through security selection and sector rotation with an investment grade focus. The U.S. Fixed Income Sleeve may also invest in high yield debt (commonly known as “junk bonds”). The strategy is based on bottom-up fundamental credit research, which takes into account the potential financial impact of ESG issues facing corporations. The fundamental bottom-up analysis will consider ESG factors alongside financial factors in the security selection and overall risk management process. The evaluation process aims to mitigate extreme losses through ESG tail risk management. Portfolio managers have the ability to weight risks relative to market compensation and relative to corporate strategies that seek to address identified ESG concerns. The U.S. Fixed Income Sleeve portfolio managers benchmark their performance against the Bloomberg Barclays US Aggregate Bond Index and the Bloomberg Barclays MSCI US Aggregate ESG Focus Index. Investments made through the U.S. Fixed Income Sleeve are not considered “opportunistic” holdings, even where the specific instruments (e.g., high yield debt) would otherwise be eligible for inclusion in the Opportunistic Component.

As a portion of the Equity Component described above, the Fund intends to make use of a managed volatility strategy that focuses on investments in globally diverse equity securities, including emerging market equities (“Managed Volatility Sleeve”), and is managed by a dedicated team of portfolio managers. The strategy of the Managed Volatility Sleeve centers on the team’s belief that individual investment styles (Value, Revisions, Momentum, Growth, and Quality) carry long-term “risk premiums” that are largely independent of the current economic or market environment that can be captured using a disciplined investment approach. “Risk premiums” represent the added value resulting from investments in certain sub-segments of the market that may carry higher risks but have historically led to higher return. Additionally, the portfolio managers apply an investment constraint requiring each individual security within the Managed Volatility Sleeve to have earned a minimum rating for any of the three “E”, “S”, or “G” components at the time of purchase. The ESG screening process begins with scores developed by MSCI that are based on company sustainability disclosure, government and academic data and media searches, among other sources. An internal ESG research team may then adjust the scores based on proprietary fundamental analysis of the MSCI flagged ESG-related risks. The sleeve’s strategy focuses on the overall management of portfolio volatility and favors stocks that demonstrate lower beta and is measured against the performance of the MSCI ACWI Minimum Volatility Index.

The Fund may invest in any type of equity or fixed income security, including common and preferred stocks, warrants and convertible securities, mortgage-backed securities, asset-backed securities and government and corporate bonds. The Fund may invest in securities of companies of any capitalization, including smaller capitalization companies. The Fund also may make investments intended to provide exposure to one or more commodities or securities indices, currencies, and real estate-related securities. The Fund is expected to be highly diversified across industries, sectors, and countries. The Fund may liquidate a holding if it locates another instrument that offers a more attractive exposure to an asset class or when there is a change in the Fund’s target asset allocation or allocation among dedicated sleeves, or if the instrument is otherwise deemed inappropriate.

In implementing these investment strategies, the Fund may make substantial use of over-the-counter (OTC) or exchange-traded derivatives, including futures contracts, interest rate swaps, total return swaps, credit default swaps, options (puts and calls) purchased or sold by the Fund, currency forwards, and structured notes. The Fund may use derivatives for a variety of purposes, including: as a hedge against adverse changes in the market price of securities, interest rates, or currency exchange rates; as a substitute for purchasing or selling securities; to increase the Fund’s return as a non-hedging strategy that may be considered speculative; and to manage portfolio characteristics. When making use of volatility-linked derivatives as part of its Opportunistic Component, the Fund will enter into instruments such as variance swaps, volatility futures and similar volatility instruments that reference indexes representing targeted asset classes, such as variance swaps on the S&P 500 Index or on the Euro Stoxx 50 Index. Derivatives positions are eligible to be held in any of the Equity Component, the Fixed Income Component and the Opportunistic Component of the Fund. The Fund may maintain a significant percentage of its assets in cash and cash equivalents which will serve as margin or collateral for the Fund’s obligations under derivative transactions.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are allocation risk, commodity and commodity-linked instruments risk, counterparty risk, credit risk, currency risk, debt instruments risk, derivatives risk, emerging markets risk, equity securities risk, focused investment risk, foreign investing risk, high yield fixed income securities (junk bonds) risk, index risk, interest rate risk, issuer risk, IPO risk, leverage risk, liquidity risk, market volatility risk, mortgage-related and other asset-backed risk, portfolio turnover risk, real estate investment risk, small and medium market capitalization companies risk, sustainable investing risk, tax risk, portfolio turnover risk, underlying fund risk and variable distribution risk.

Virtus Newfleet Multi-sector Intermediate Bond (VMFRX)

Investment Objective and Principal Strategies

This Fund’s primary investment objective is to maximize current income while preserving capital. The fund seeks to generate high current income and total return while preserving capital by applying extensive credit research and a time-tested approach designed to capitalize on opportunities across undervalued sectors of the bond market. The portfolio seeks diversification among 14 sectors in an effort to increase return potential and reduce risk.

Under normal circumstances, the fund invests at least 80% of its assets in bonds, which are debt securities of various types of issuers. The fund seeks to achieve its objective by investing in a diversified portfolio of primarily intermediate-term bonds having a dollar-weighted average maturity of between three and 10 years and that are in one of the following market sectors:

- Securities issued or guaranteed as to principal and interest by the U.S. Government, its agencies, authorities or instrumentalities;

- Collateralized mortgage obligations (“CMOs”), real estate mortgage investment conduits (“REMICs”), and other pass-through securities, including those issued or guaranteed as to principal and interest by the U.S. Government, its agencies, authorities or instrumentalities;

- Debt securities issued by foreign issuers, including foreign governments and their political subdivisions and issuers located in emerging markets;

- Investment-grade securities (primarily of U.S. issuers, secondarily of non-U.S. issuers), which are securities with credit ratings within the four highest rating categories of a nationally recognized statistical rating organization, including short-term securities; and

- High-yield/high-risk debt instruments (so-called “junk bonds”), including bank loans (which are generally floating-rate).

The fund may invest in all or some of these sectors.

The fund may use credit default swaps to increase or hedge (decrease) investment exposure to various fixed income sectors and instruments.

Principal Risks

The fund may not achieve its objective(s), and it is not intended to be a complete investment program. The value of the fund’s investments that supports your share value may decrease. If between the time you purchase shares and the time you sell shares the value of the fund’s investments decreases, you will lose money. Investment values can decrease for a number of reasons. Conditions affecting the overall economy, specific industries or companies in which the fund invests can be worse than expected, and investments may fail to perform as the subadviser expects. As a result, the value of your shares may decrease. Purchase and redemption activities by fund shareholders may impact the management of the fund and its ability to achieve its investment objective(s). The principal risks of investing in the fund are credit risk, interest rate risk, high-yield fixed income securities risk, bank loan risk, foreign investing risk, emerging market risk, mortgage-backed and asset-backed securities risk, market volatility risk, derivatives risk, income risk, long-term maturities/durations risk, prepayment/call risk, redemption risk, and U.S. government securities risk.

Virtus NFJ Dividend Value Fund (ANDVX)

Investment Objective and Principal Strategies

The Fund seeks long-term growth of capital and income. The Fund seeks to achieve its investment objective by normally investing at least 80% of its net assets (plus borrowings made for investment purposes) in common stocks and other equity securities of companies that pay or are expected to pay dividends. Under normal conditions, the Fund will invest primarily in common stocks of companies with market capitalizations greater than $3.5 billion. The portfolio managers use a value investing style focusing on companies whose securities the portfolio managers believe have attractive valuation and fundamental strength. The portfolio managers partition the Fund’s selection universe by industry and then identify what they believe to be the most attractively valued securities in each industry to determine potential holdings for the Fund representing a broad range of industry groups. The portfolio managers use initial parameters and quantitative tools to narrow the Fund’s selection universe and also review and consider fundamental changes. In selecting individual holdings and constructing the overall portfolio, the portfolio managers take into account the dividend yields of their investments. After narrowing the universe through a combination of qualitative analysis and fundamental research, the portfolio managers select securities for the Fund. In addition to common stocks and other equity securities, the Fund may also invest up to 25% of its assets in real estate investment trusts (REITs) and real estate-related investments, and a portion of its assets in non-U.S. securities (including through American Depositary Receipts (ADRs)), including emerging market securities. The Fund may utilize foreign currency exchange contracts, options, stock index futures contracts and other derivative instruments. Although the Fund did not invest significantly in derivative instruments as of the most recent fiscal year end, it may do so at any time.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are allocation risk, counterparty risk, credit risk, currency rate risk, depositary receipts risk, derivatives risk, emerging markets risk, equity securities risk, focused investment risk, foreign investing risk, issuer risk, liquidity risk, market volatility risk, real estate investment risk, portfolio turnover risk and small and medium market capitalization companies risk.

Virtus Silvant Focused Growth Fund (AFGFX)

Investment Objective and Principal Strategies

The Fund seeks long-term capital appreciation. The Fund seeks to achieve its investment objective by normally investing primarily in equity securities of U.S. companies with market capitalizations of at least $1 billion. The Fund may also invest up to 20% of its assets in non-U.S. securities (but no more than 10% in any one non-U.S. country or 10% in emerging market securities). At times, depending on market conditions, the Fund may also invest a significant percentage of its assets in a small number of business sectors or industries. The portfolio managers normally select 25 to 45 stocks for the Fund’s portfolio.

The portfolio managers attempt to include securities in the Fund’s portfolio that exhibit the greatest combination of earnings growth potential, quality (as reflected in consistent business fundamentals) and attractive valuation. The portfolio managers ordinarily look for several of the following characteristics when analyzing specific companies for possible investments: higher than average growth and strong potential for capital appreciation; substantial capacity for growth in revenue, cash flow or earnings through either an expanding market or expanding market share; a strong balance sheet; superior management; strong commitment to research and product development; and differentiated or superior products and services or a steady stream of new products and services. Based in part on a proprietary environmental, social and corporate governance (“ESG”) scoring model, companies’ ESG practices and risk factors are considered as part of the investment process, namely for the purposes of identifying tail risk factors arising from a company’s ESG practices and understanding how a company’s ESG risk factors might affect the company and its performance. The portfolio managers maintain discretion to invest in companies with low ESG scores and to exclude companies with high ESG scores from the Fund’s portfolio. In addition to common stocks and other equity securities (such as preferred stocks, convertible securities and warrants), the Fund may utilize foreign currency exchange contracts, options, stock index futures contracts and other derivative instruments. Although the Fund did not invest significantly in derivative instruments as of the most recent fiscal year end, it may do so at any time.

Principal Risks

The principal risks of investing in the Fund, which could adversely affect its net asset value, yield and total return, are allocation risk, counterparty risk, credit risk, currency rate risk, derivatives risk, emerging markets risk, equity securities risk, focused investment risk, foreign investing risk, issuer risk, leverage risk, liquidity risk, non-diversification risk market volatility risk, portfolio turnover risk and preferred stocks risk.